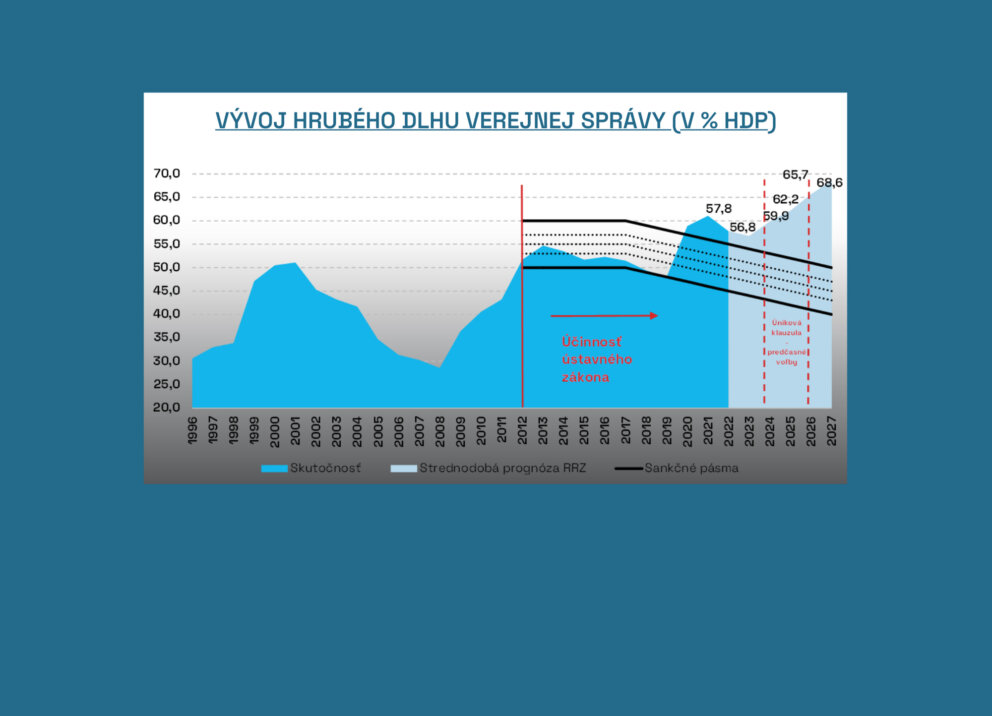

Odhad k mesiacu: 03/2024

Rozpočet 2024: -6,0 % HDP

Odchýlka: +0,2 % HDP

Novinky

Prinášame Vám užitočné nástroje

O Rozpočtovej rade

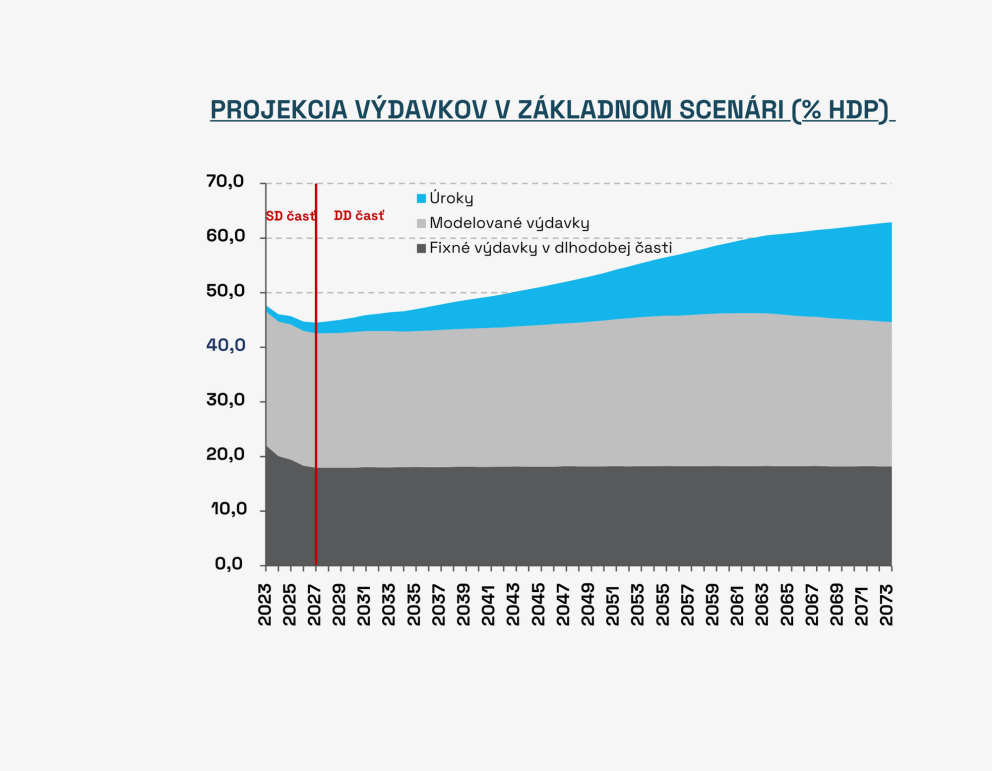

Rada pre rozpočtovú zodpovednosť vznikla v roku 2012 ako nezávislý orgán monitorovania a hodnotenia vývoja hospodárenia Slovenskej republiky.

Prostredníctvom profesionálnej práce a na základe najmodernejších analytických nástrojov by rada mala nastavovať zrkadlo vláde, zlepšiť informovanosť verejnosti.

Komentáre